45l tax credit certification

The Arkansas homes were built in Zone 3 to 2012 IRC minimum code and 2014 Arkansas Energy Code for New Building Construction. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

45l The Energy Efficient Home Credit

Check Out the Latest Info.

. Code 45L - New energy efficient home credit. In order to receive a PBC Certificate a conservation easement governing the future use of the parcel must be placed on the parcel and filed with the Suffolk County Clerk. The leader in 45L Tax Credit certification support service including EnergyPro 45L software Raters services and free 45L plan reviews.

If you received your original Marriage License from the Town of Smithtown the Town Clerks Office can issue a certified copy of your Marriage. Most projects built to 2016 and 2019 California energy code already. Detailed energy analysis documents and reports can be provided including Energy Star certification.

Qualifying properties include apartments. Ad 45l tax credit certification. Learn More at AARP.

The 45L Tax certificate which. The 45L credit is one of many benefits of the HERS rating. The 45L Energy-Efficient Home Tax Credit is equal to 2000 per residential unit or dwelling to the developers of energy-efficient buildings.

In late 2019 the tax credit was. 45l Tax Credit Certification. If youre not sure you qualify for the.

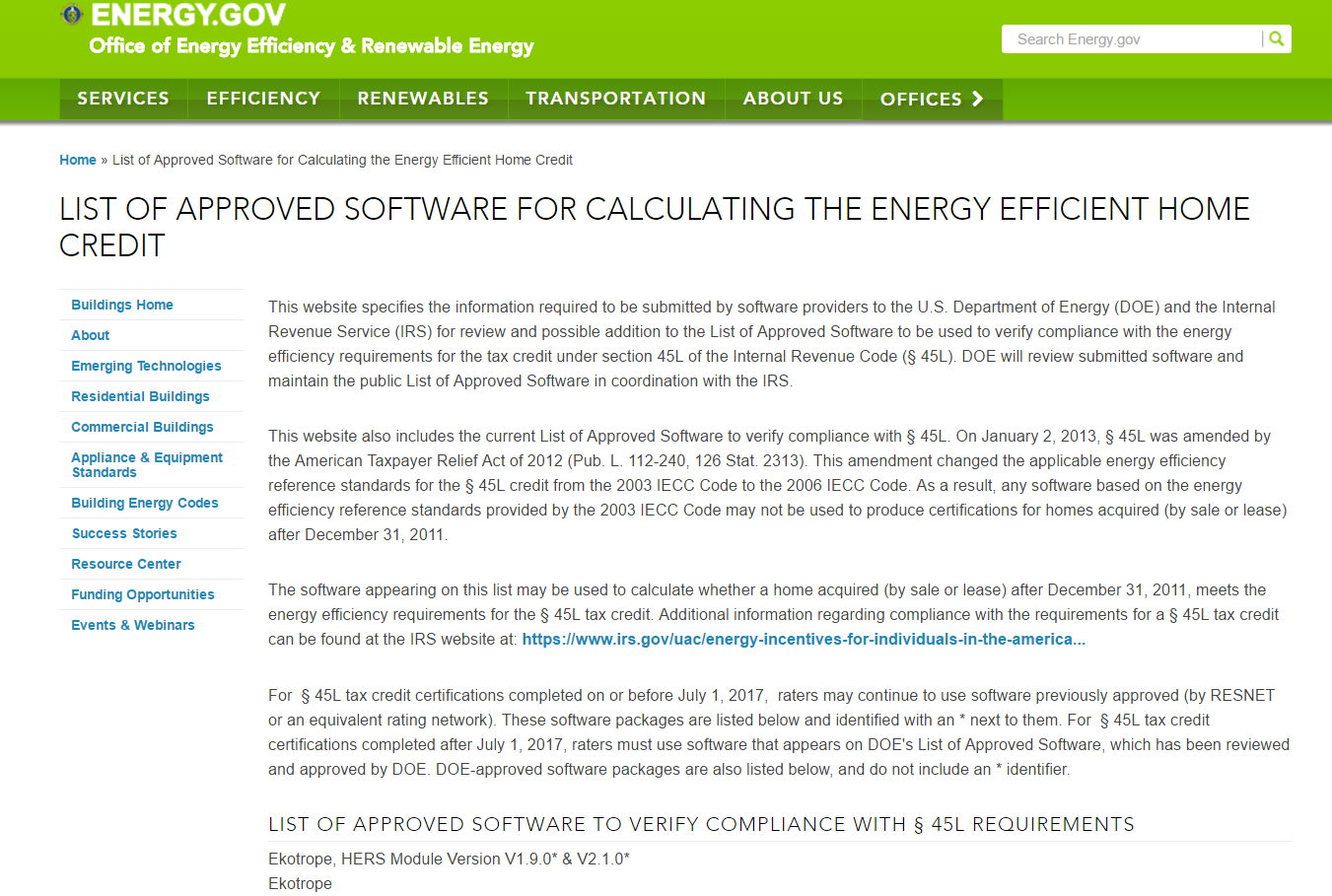

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. This notice also provides for a public list of software programs that may be used in calculating energy consumption for purposes of. If the credit reduces tax to less than zero the taxpayer could even receive a refund.

Ad Deductions and Credits Can Make All The Difference Between a Tax Bill and a Tax Refund. The 45L Tax Credit is a Federal Tax Credit worth 2000 per dwelling unit that rewards multifamily developers investors and homebuilders that develop energy efficient. 45Lc1A and B of the Internal Revenue Code.

Taxpayers who pay for higher. Browse Our Collection and Pick the Best Offers. The 45L tax credit provides developers of energy efficient homes and apartment buildings up to 2000 per dwelling unit.

Certification should be made in writing specifying in a readily verifiable fashion the energy efficient building envelope components and energy efficient heating or cooling. The good news is that you can go back and claim the 45L credit for properties that have been built or remodeled in the past three years. 6 Often Overlooked Tax Breaks You Wouldnt Want to Miss.

A certification described in subsection c shall be made in. Arkansas Home Builder sold 35. Use this lookup to determine the amount youll receive for the homeowner tax rebate credit HTRC.

These credits reduce the amount of tax someone owes. Quick search by citation. How to Request a Marriage Certificate.

Weve already started mailing checks.

Federal Energy Tax Credits 45l Are Back Ducttesters Inc

Section 45l Cost Segregation Authority

Engineered Tax Services Home Facebook

Yearend Tax Credit Reminders Act Now Novogradac

What Is The 45l Tax Credit Get 2k Per Dwelling Unit

Contracts Can Claim The 45l Tax Credit Tri Merit

45l Energy Efficient Home Credit Ics Tax Llc

What Is The 45l Tax Credit Cheers

U S Department Of Energy To Approve Software Tools To Calculate Compliance To Federal 45l Tax Credit For Energy Efficient Homes Resnet No Longer Approves 45l Tax Credit Software Tools Resnet

45l Tax Credit Energy Efficient Credit For Multifamily Developers Fort Worth Inc

Contracts Can Claim The 45l Tax Credit Tri Merit

45l Energy Tax Credits Jpope Tax Consultancy

Everything You Need To Know About 45l Tax Credit Mom And More

45l Tax Credit Energy Efficient Credit Richmond Cpa Firm

Environments For Living Builder 45l Tax Credits

The 2 000 45l Efficiency Tax Credit What You Need To Know Attainable Home